A new report by energy market analysts, ROAM Consulting, has been commissioned by the Clean Energy Council (CEC). They have looked at the different outcomes of the RET review and forecasting the effects that outcome would have on our electricity bills and on the energy sector.

This study confirms that the RET has been holding wholesale electricity prices lower as more and more people are less inclined to use expensive gas for electricity generation. It also confirms that gas is going to increase dramatically over the next few years.

The report looks at three different outcomes of the RET review.

1. Increasing the RET

2. Leaving everything as is

3. Abolishing the target altogether

“While the RET remains a critical policy to support Australian projects, the good news is that renewable energy is coming down in cost. The RET will help to protect consumers from the power price pain of rising gas prices, while delivering billions of dollars in investment and thousands of jobs for regional areas of the country,” says CEC chief executive David Green.

If the RET is continued or increased it would lead to lower electricity prices, lower carbon emissions and increased competition.

If the RET is abolished it will restrict renewables development, increase reliance on fossil fuelled generation and eventually push power prices higher.

“In the shorter-term, to 2017-18, repealing the RET would save consumers $11 to $22 each year on an annual bill of over $1,700,” says the report. However, after that to 2020 it would cost an extra half a billion dollars each year for electricity (equivalent of $50 per year) and beyond 2020 it would cost an extra 1.4 billion each year (equivalent to $140 per year).

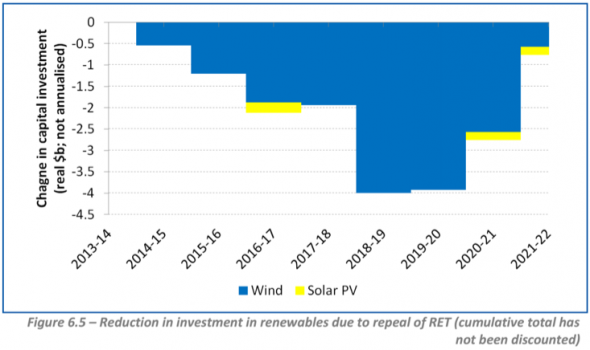

In addition to the added costs, if the RET was abolished we would be risking $14.5 billion in investment opportunities as well as losing out on 18 400 jobs that would have been created.

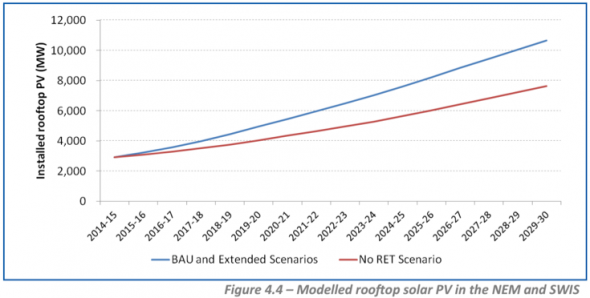

The following shows what would have to rooftop solar power systems if the RET is continued (blue line) and if the RET was removed (red line).

The following chart show what the results would be on investments if the RET was removed.

We are still to find out what the panel is going to decide on the RET Review. The whole industry seems to be at a loss and unsure how the situation will pan out.

“We have not made a decision on that – how could we when we have just started consulting with the industry,” says RET Review panel chief Dick Warburton.

Click here to download a copy of the report.